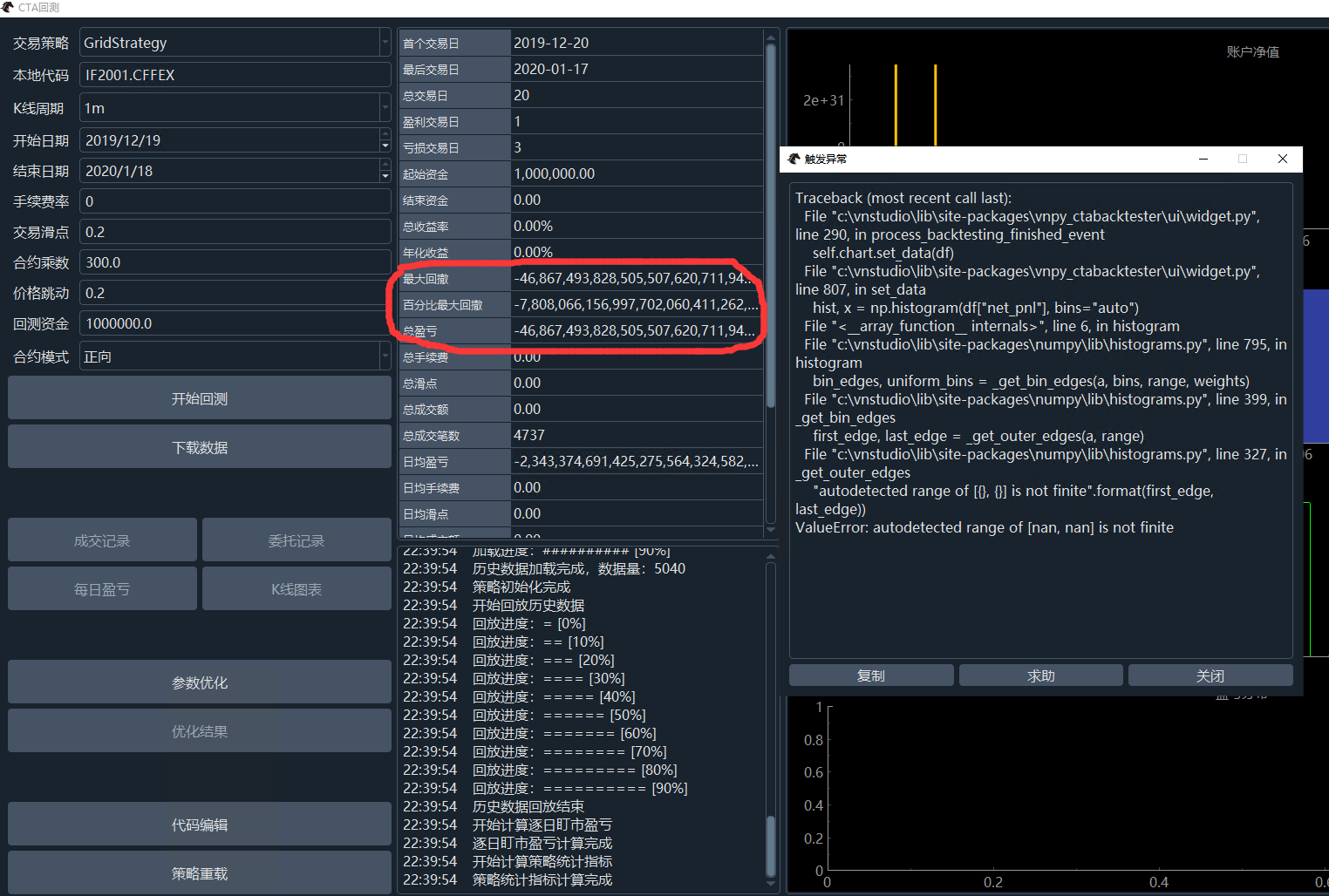

写了一个网格交易的策略,回测的时候,最大回撤都无穷大了,请问是怎么回事呢?

from vnpy.app.cta_strategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

import math

class GridStrategy(CtaTemplate):

""""""

author = "Fighter"

#定义参数

initial_price = 1.0

step_price = 1.0

step_volume = 1.0

max_pos = 4

vt_orderid = ""

pos = 0

parameters = ["initial_price", "step_price", "step_volume", "max_pos"]

variables = ["pos", "vt_orderid"]

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

""""""

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.bg = BarGenerator(self.on_bar)

self.am = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(1)

self.pos = 0

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

self.put_event()

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

self.put_event()

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

self.bg.update_tick(tick)

def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

#self.bg.update_bar(bar)

#self.cancel_all()

am = self.am

am.update_bar(bar)

if not am.inited:

return

if self.initial_price > bar.close_price:

# 价格在基准价之上时

# 计算当前K线收盘价与初始价的距离

target_buy_distance = (self.initial_price - bar.close_price) / self.step_price

# 计算当前价位应该持有的仓位,取整。再和最大仓位置比较

target_buy_position = min(math.floor(target_buy_distance) * self.step_volume, self.max_pos)

# 当前应该持有的仓位减去原有持仓就是该再买入的仓位

target_buy_volume = target_buy_position - self.pos

# Buy when price dropping

if target_buy_volume > 0:

self.buy(bar.close_price, target_buy_volume)

# Sell when price rising

elif target_buy_volume < 0:

self.sell(bar.close_price, target_buy_volume)

elif self.initial_price < bar.close_price:

# 价格在基准价之下时

target_buy_distance = (bar.close_price - self.initial_price) / self.step_price

target_buy_position = - min(math.floor(target_buy_distance) * self.step_volume, self.max_pos)

target_buy_volume = target_buy_position - self.pos

# Buy when price dropping

if target_buy_volume > 0:

self.buy(bar.close_price, target_buy_volume)

# Sell when price rising

elif target_buy_volume < 0:

self.sell(bar.close_price, target_buy_volume)

# Update UI

#self.put_variables_event()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass