MTF wrote:

贴下具体的策略代码?

```

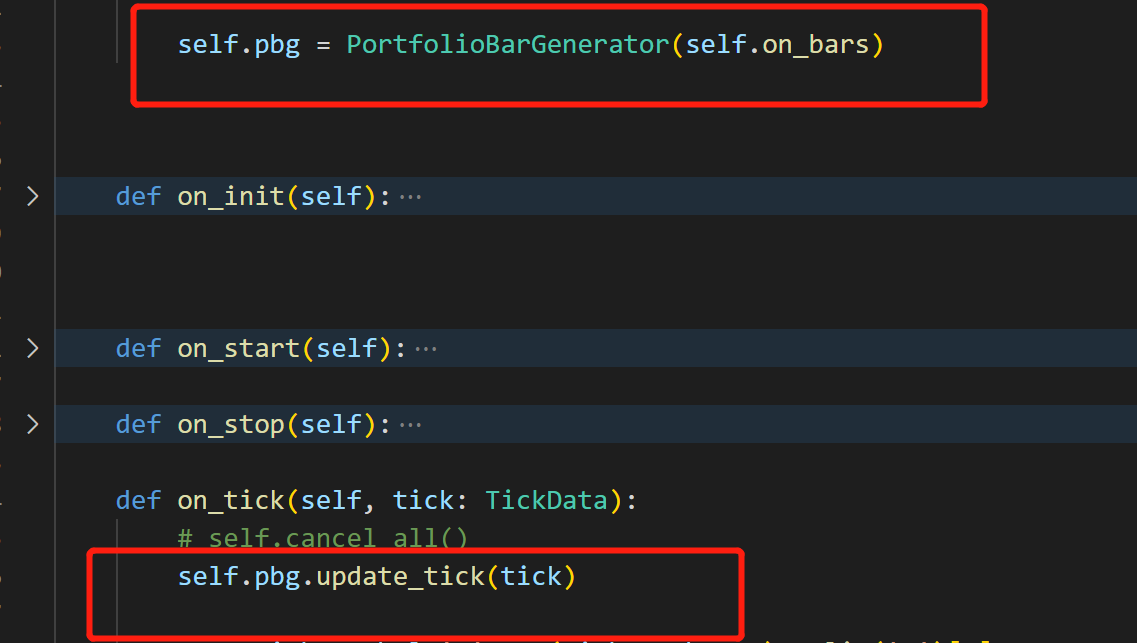

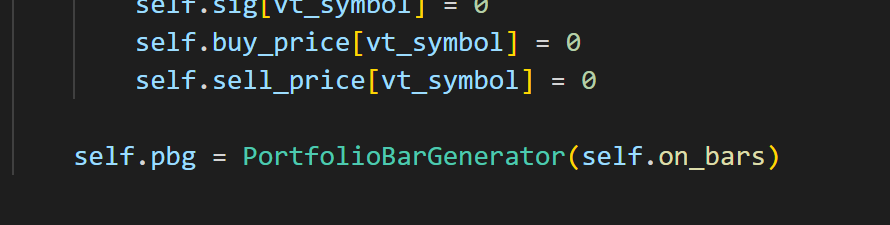

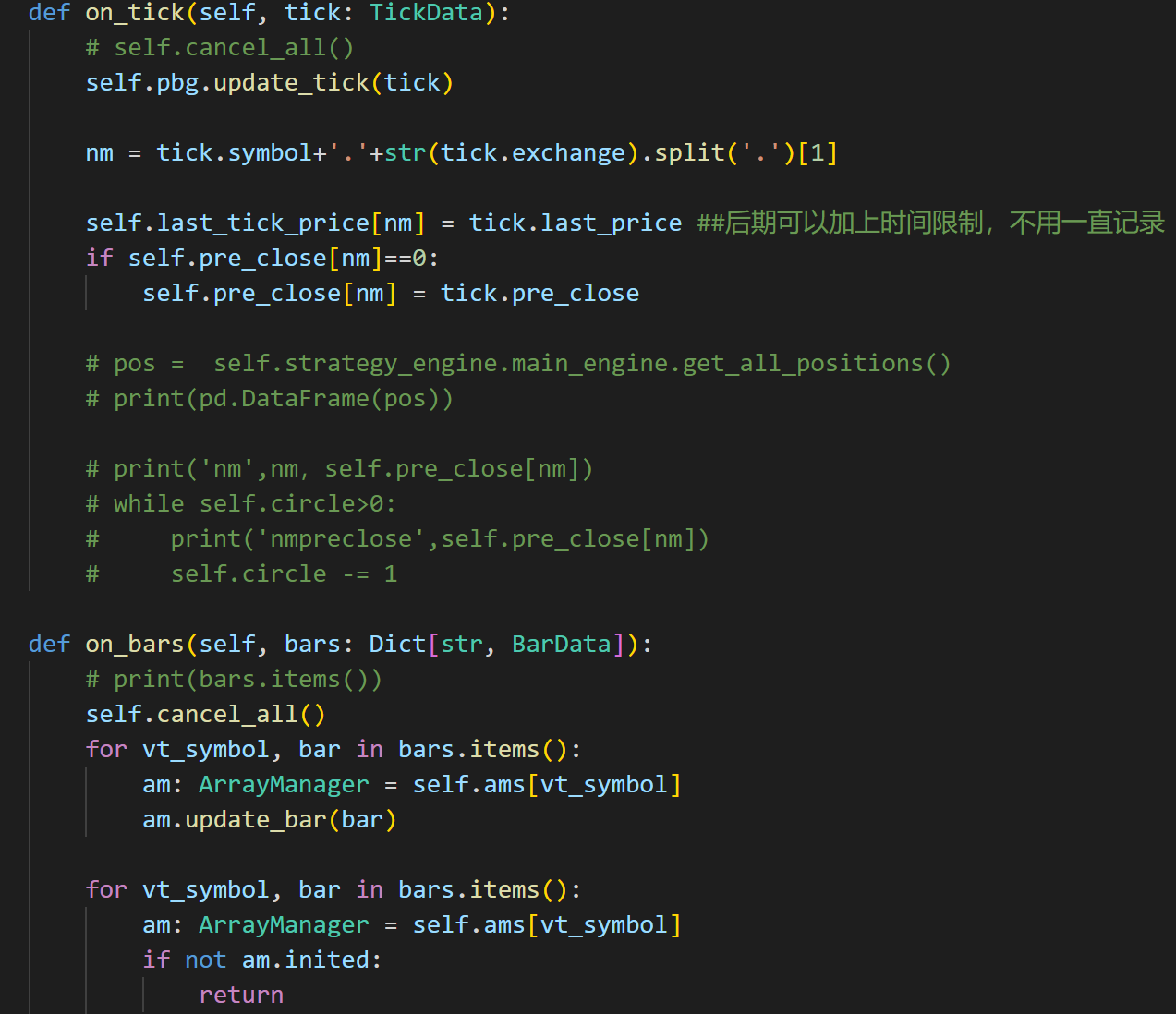

def on_tick(self, tick: TickData):

# self.cancel_all()

self.pbg.update_tick(tick)

nm = tick.symbol+'.'+str(tick.exchange).split('.')[1]

self.last_tick_price[nm] = tick.last_price ##后期可以加上时间限制,不用一直记录

if self.pre_close[nm]==0:

self.pre_close[nm] = tick.pre_close

# pos = self.strategy_engine.main_engine.get_all_positions()

# print(pd.DataFrame(pos))

# print('nm',nm,self.pre_close[nm])

# while self.circle>0:

# print('nmpreclose',self.pre_close[nm])

# self.circle -= 1

def on_bars(self, bars: Dict[str, BarData]):

# print(bars.items())

self.cancel_all()

for vt_symbol, bar in bars.items():

am: ArrayManager = self.ams[vt_symbol]

am.update_bar(bar)

for vt_symbol, bar in bars.items():

am: ArrayManager = self.ams[vt_symbol]

if not am.inited:

return

# vt_symbol = bar.symbol+'.'+str(bar.exchange).split('.')[1]

ava_cash = self.percent*5000000 #0.1*(self.get_account(self).balance-self.get_account(self).frosen)#

#self.cta_engine.main_engine.get_account("12345.CTP")

#self.get_account(self).balance-self.get_account(self).frosen

if vt_symbol in self.vt_symbols:

if len(self.pdata[vt_symbol])<20:

self.pdata[vt_symbol].append(bar.close_price)

else:

self.pdata[vt_symbol].pop(0)

self.pdata[vt_symbol].append(bar.close_price)

# pos_data = pd.DataFrame(self.strategy_engine.main_engine.get_all_positions())#self.get_pos(vt_symbol)

# pos_dict = dict(zip(list(pos)))

current_pos = self.get_pos(vt_symbol)

print(vt_symbol,"当前持仓:",current_pos,self.sig[vt_symbol])

if current_pos==0 and self.sig[vt_symbol]==0:#self.sig[vt_symbol]==0:

#self.sig[vt_symbol]==0

#判断是否开仓

if (bar.datetime.time() >= datetime.time(10,0) and bar.datetime.time()<= datetime.time(15,0))\

or (bar.datetime.time() >= datetime.time(21,10)):

if vt_symbol in self.up_pool:

# print("一些信息:",vt_symbol,bar.close_price,self.up_threshold[vt_symbol])

if bar.close_price>self.up_threshold[vt_symbol]:# and (self.pre_close[vt_symbol]<self.up_threshold[vt_symbol]):

# print(vt_symbol,'cross') #and self.pre_close[vt_symbol]<=self.up_threshold[vt_symbol]:

# print(max(self.pdata[vt_symbol]),self.up_threshold[vt_symbol])

bid_price = bar.close_price

#np.ceil(bar.close_price + min(self.orderstep*self.get_pricetick(vt_symbol),np.mean(np.diff(self.pdata[vt_symbol]))))

bid_vol = math.floor(self.percent*ava_cash/(self.get_size(vt_symbol)*bid_price*self.up_margin[vt_symbol]))

self.buy_price[vt_symbol] = bid_price

print('信号值:',self.sig[vt_symbol])

self.sig[vt_symbol] = 1

self.targets[vt_symbol] = bid_vol

# order = self.buy(vt_symbol, bid_price, max(1,bid_vol))

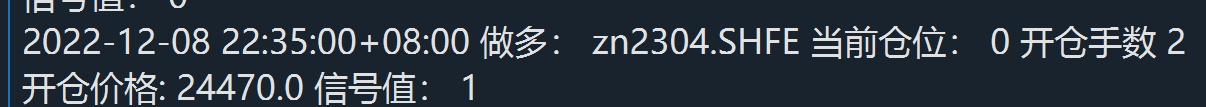

print(bar.datetime,'做多:',vt_symbol,'当前仓位:',current_pos,'开仓手数',bid_vol,'开仓价格:',bid_price,'信号值:',self.sig[vt_symbol])

elif vt_symbol in self.dn_pool:

if bar.close_price<self.dn_threshold[vt_symbol]:# and (self.pre_close[vt_symbol]>self.dn_threshold[vt_symbol]):

# print(min(self.pdata[vt_symbol]),self.up_threshold[vt_symbol])

# ask_price = math.ceil(tick.last_price - min(self.orderstep*self.get_pricetick(vt_symbol),np.mean(np.diff(self.pdata[vt_symbol]))))

ask_price = bar.close_price

ask_vol = math.floor(self.percent*ava_cash/(self.get_size(vt_symbol)*ask_price*self.dn_margin[vt_symbol]))

self.targets[vt_symbol] = -ask_vol

self.sell_price[vt_symbol] = ask_price

# self.short(vt_symbol, ask_price, max(ask_vol,1))

print('信号值:',self.sig[vt_symbol])

self.sig[vt_symbol] = -1

print(bar.datetime,'做空:',vt_symbol,'当前仓位:',current_pos,'开仓手数:',ask_vol,'开仓价格:',ask_price,'信号值:',self.sig[vt_symbol])

elif current_pos > 0 and self.sig[vt_symbol]>0:

if len(self.pdata[vt_symbol])>5:

long_profit = bar.close_price/self.buy_price[vt_symbol]-1

ask_price = math.ceil(bar.close_price - min(self.orderstep*self.get_pricetick(vt_symbol),np.mean(np.diff(self.pdata[vt_symbol]))))

if long_profit<self.start_stop:

if bar.close_price < 0.95*self.up_threshold[vt_symbol] and min(self.pdata[vt_symbol][-5:-1])>self.up_threshold[vt_symbol]:

self.targets[vt_symbol] = 0

print('平多1')

# self.sig[vt_symbol] = 0

else:

ma_new = (self.ma[vt_symbol]+bar.close_price)/self.period_2

if long_profit>1.5*self.start_stop:

self.targets[vt_symbol] = 0

print('平多2')

# self.sig[vt_symbol] = 0

elif bar.close_price < ma_new and min(self.pdata[vt_symbol][-5:-1])>ma_new and self.sell_signal[vt_symbol]==1:

self.targets[vt_symbol] = 0

print('平多3')

# self.sig[vt_symbol] = 0

elif current_pos < 0 and self.sig[vt_symbol] < 0:

print('当前仓位:',current_pos,'信号值:',self.sig[vt_symbol])

if len(self.pdata[vt_symbol])>5:

short_profit = self.sell_price[vt_symbol]/bar.close_price-1

bid_price = math.ceil(bar.close_price + min(self.orderstep*self.get_pricetick(vt_symbol),np.mean(np.diff(self.pdata[vt_symbol]))))

if short_profit<self.start_stop:

if bar.close_price > 1.05*self.dn_threshold[vt_symbol] and max(self.pdata[vt_symbol][-5:-1])<=self.dn_threshold[vt_symbol]:

self.targets[vt_symbol] = 0

print('平空1')

# self.sig[vt_symbol] = 0

else:

ma_new = (self.ma[vt_symbol]+bar.close_price)/self.period_2

if short_profit>1.5*self.start_stop:

self.targets[vt_symbol] = 0

print('平空2')

# self.sig[vt_symbol] = 0

elif bar.close_price > ma_new and max(self.pdata[vt_symbol][-5:-1])<=ma_new and self.buy_signal[vt_symbol]==1:

self.targets[vt_symbol] = 0

print('平空3')

# self.sig[vt_symbol] = 0

#判断是否平仓

for vt_symbol in self.vt_symbols:

target_pos = self.targets[vt_symbol]

current_pos = self.get_pos(vt_symbol)

pos_diff = target_pos - current_pos

volume = abs(pos_diff)

price = self.last_tick_price[vt_symbol]

if pos_diff > 0:#开多或平空

# price = bars[vt_symbol].close_price

if current_pos < 0:

self.cover(vt_symbol, price, volume)

self.sig[vt_symbol] = 0

else:

self.buy(vt_symbol, price, volume)

# self.sig[vt_symbol] = 1

elif pos_diff < 0:

# price = bars[vt_symbol].close_price

if current_pos > 0:

self.sell(vt_symbol, price, volume)

self.sig[vt_symbol] = 0

else:

self.short(vt_symbol,price, volume)

# self.sig[vt_symbol] = -1

self.put_event()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

```