闲来无事,在家把之前的编写的策略如何一步一步实现的记录下来了!

在B站发了些自己做的关于量化的视频,只是简单的记录一下自己是

如何一步一步走进这个量化坑的,希望可以帮助新手少走一些坑。

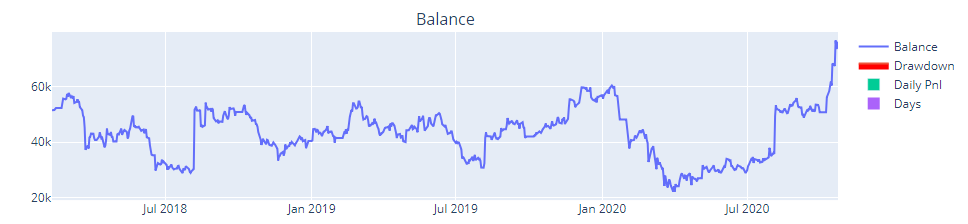

这个策略,实盘肯定不行的,只是记录下编写策略的一个流程。

我在B站发的视频,欢迎大家点赞关注 /😊/😊/😊/😊/😊/😊/😊

https://www.bilibili.com/video/BV1pV411r7Kt?p=10

视频只是简单的记录自己之前做的一些思路,高手别喷(●ˇ∀ˇ●)

质量肯定没法和官方的比 最后还是希望大家多多支持官方

from vnpy.app.cta_strategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

from vnpy.trader.constant import Interval

class Demo01(CtaTemplate):

""""""

# 参数

fast_window = 30 # 快速均线

slow_window = 60 # 慢速均线

x_min = 30 # 交易周期 默认是15分钟

lots = 1 # 开仓手数

save = 20 # 止损参数

startstop = 100 # 开始止盈

stoploss = 40 # 回撤点位

daily_window = 10 # 日线的参数

max_lots = 3

flag=0

# 变量

fast_ma = 0

fast_ma_pre = 0

slow_ma = 0

slow_ma_pre = 0

price = 0 # tick的实时价格

bartime = "" # 时间的显示

avg_buy_price = 0

avg_sell_price = 0

highest = 0

lowest = 0

daily_ma = 0

liqDays = 60

liqpoint = 0

holding_days = 0

run_buy=False

run_sell=False

parameters = ["fast_window", "slow_window", "x_min", "lots", 'stoploss', 'startstop', 'save']

variables = ["bartime", "price", "fast_ma", "slow_ma", 'highest', 'lowest']

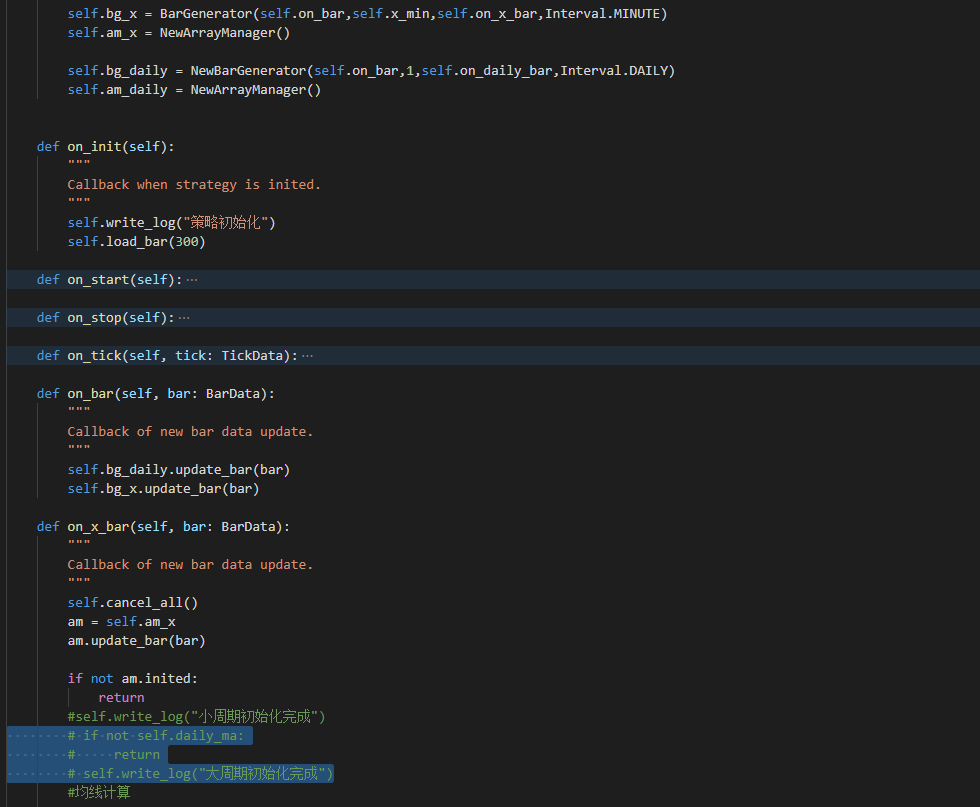

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

""""""

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.bg_x = BarGenerator(self.on_bar, self.x_min, self.on_x_bar, Interval.MINUTE)

self.am_x = ArrayManager()

self.bg_daily = BarGenerator(self.on_bar, 1, self.on_daily_bar, Interval.DAILY)

self.am_daliy = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.load_bar(30)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

self.bg_x.update_tick(tick)

self.price = tick.last_price

if self.pos > 0:

if tick.last_price < self.avg_buy_price - self.save*2:

self.sell(tick.last_price*0.9, abs(self.pos))

print(tick.datetime, tick.last_price, "保命出场")

self.flag+=1

elif self.pos < 0:

if tick.last_price > self.avg_sell_price + self.save*2:

self.cover(tick.last_price*1.2, abs(self.pos))

print(tick.datetime, tick.last_price, "保命出场")

self.flag+=1

self.put_event()

def on_bar(self, bar: BarData):

self.bg_x.update_bar(bar)

self.bg_daily.update_bar(bar)

def on_x_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.cancel_all()

am = self.am_x

am.update_bar(bar)

if not am.inited:

return

# ma30的计算

self.fast_ma = am.close_array[-self.fast_window:-1].mean()

# 之前的ma30的计算

self.fast_ma_pre = am.close_array[-self.fast_window - 1:-2].mean()

# ma60的计算

self.slow_ma = am.close_array[-self.slow_window:-1].mean()

# 之前的ma60的计算

self.slow_ma_pre = am.close_array[-self.slow_window - 1:-2].mean()

self.run_buy=bar.close_price<=am.close_array[-2]*1.05

self.run_sell=bar.close_price>=am.close_array[-2]*0.95

if self.pos == 0:

# 金叉开多

if self.fast_ma_pre < self.slow_ma_pre and self.fast_ma > self.slow_ma:

if bar.close_price > self.daily_ma and self.run_buy:

self.buy(bar.close_price,min(self.lots,self.max_lots))

self.highest = bar.close_price

self.avg_buy_price = bar.close_price

self.holding_days = 0

print(bar.datetime, bar.close_price, "开多单","开仓手数:",min(self.lots,self.max_lots))

elif self.fast_ma_pre > self.slow_ma_pre and self.fast_ma < self.slow_ma:

# 死叉开空

if bar.close_price < self.daily_ma and self.run_sell:

self.short(bar.close_price,min(self.lots,self.max_lots))

self.lowest = bar.close_price

self.avg_sell_price = bar.close_price

self.holding_days = 0

print(bar.datetime, bar.close_price, "开空单","开仓手数:",min(self.lots,self.max_lots))

elif self.pos > 0:

# 持有多单的最高价记录

self.highest = max(bar.high_price, self.highest)

# 多单止损的逻辑

if bar.close_price < self.avg_buy_price - self.save:

self.sell(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "多单止损","止损手数:",abs(self.pos))

self.flag+=1

# 多单止盈

elif self.highest > self.avg_buy_price + self.startstop:

if bar.close_price < self.highest - self.stoploss:

self.sell(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "多单止盈","止盈手数:",abs(self.pos))

self.flag=0

elif self.holding_days > 20 and bar.close_price < self.liqpoint:

self.sell(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "多单自适应均线出场","平仓手数:",abs(self.pos))

# if self.avg_buy_price<bar.close_price:

# self.flag=0

# else:

# self.flag+=1

elif self.pos < 0:

# 持有空单的最低价记录

self.lowest = min(bar.low_price, self.lowest)

# 空单止损的逻辑

if bar.close_price > self.avg_sell_price + self.save:

self.cover(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "空单止损","止损手数:",abs(self.pos))

self.flag+=1

# 空单止盈

elif self.lowest < self.avg_sell_price - self.startstop:

if bar.close_price > self.lowest + self.stoploss:

self.cover(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "空单止盈", "止盈手数:", abs(self.pos))

self.flag=0

elif self.holding_days > 20 and bar.close_price > self.liqpoint:

self.cover(bar.close_price, abs(self.pos))

print(bar.datetime, bar.close_price, "空单自适应均线出场","平仓手数:",abs(self.pos))

# if self.avg_sell_price > bar.close_price:

# self.flag =0

# else:

# self.flag += 1

if self.pos != 0:

self.holding_days += 1

else:

self.liqDays = self.slow_window

if self.pos != 0 and self.holding_days >= 20:

self.liqDays -= 1

self.liqDays = max(self.liqDays, 50)

self.liqpoint = am.close_array[-self.liqDays:].mean()

self.lots=2 if self.flag>=2 else 1

self.put_event()

def on_daily_bar(self, bar: BarData):

self.cancel_all()

am = self.am_daliy

am.update_bar(bar)

if not am.inited:

return

self.daily_ma = am.close_array[-self.daily_window:-1].mean()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass