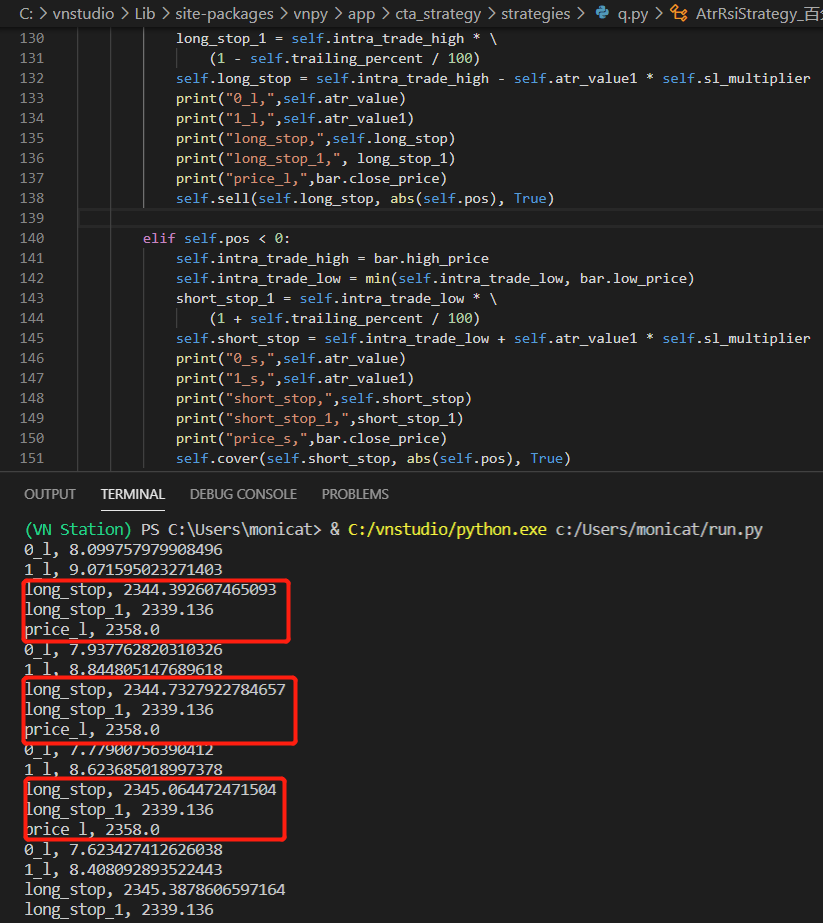

老师好,我把vnpy自带策略AtrRsiStrategy中的百分比止损参照BollChannelStrategy策略

修改为ATR止损,修改了一下,但是回测总是交易非常多的笔数,异常,只是一个简单的修改还出错,十分困惑,望老师帮忙指点纠正一下,万分感激

from vnpy.app.cta_strategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

class AtrRsiStrategy_百分比修改为atr(CtaTemplate):

""""""

author = "用Python的交易员"

atr_length = 50

atr_window = 40

atr_ma_length = 60

rsi_length = 70

rsi_entry = 30

sl_multiplier = 1.5

fixed_size = 1

atr_value = 0

atr_value1 = 0

atr_ma = 0

rsi_value = 0

rsi_buy = 0

rsi_sell = 0

intra_trade_high = 0

intra_trade_low = 0

long_stop = 0

short_stop = 0

parameters = [

"atr_length",

"atr_ma_length",

"rsi_length",

"rsi_entry",

"sl_multiplier",

"fixed_size",

"atr_window"

]

variables = [

"atr_value",

"atr_value1",

"atr_ma",

"rsi_value",

"rsi_buy",

"rsi_sell",

"intra_trade_high",

"intra_trade_low",

"long_stop",

"short_stop"

]

def __init__(self, cta_engine, strategy_name, vt_symbol, setting):

""""""

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.bg = BarGenerator(self.on_bar)

self.am = ArrayManager()

def on_init(self):

"""

Callback when strategy is inited.

"""

self.write_log("策略初始化")

self.rsi_buy = 50 + self.rsi_entry

self.rsi_sell = 50 - self.rsi_entry

self.load_bar(10)

def on_start(self):

"""

Callback when strategy is started.

"""

self.write_log("策略启动")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

self.write_log("策略停止")

def on_tick(self, tick: TickData):

"""

Callback of new tick data update.

"""

self.bg.update_tick(tick)

def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.cancel_all()

am = self.am

am.update_bar(bar)

if not am.inited:

return

atr_array = am.atr(self.atr_length, array=True)

self.atr_value = atr_array[-1]

self.atr_ma = atr_array[-self.atr_ma_length:].mean()

self.rsi_value = am.rsi(self.rsi_length)

self.atr_value1 = am.atr(self.atr_window)

if self.pos == 0:

self.intra_trade_high = bar.high_price

self.intra_trade_low = bar.low_price

if self.atr_value > self.atr_ma:

if self.rsi_value > self.rsi_buy:

self.buy(bar.close_price + 5, self.fixed_size)

elif self.rsi_value < self.rsi_sell:

self.short(bar.close_price - 5, self.fixed_size)

elif self.pos > 0:

self.intra_trade_high = max(self.intra_trade_high, bar.high_price)

self.intra_trade_low = bar.low_price

self.long_stop = self.intra_trade_high - self.atr_value1 * self.sl_multiplier

self.sell(self.long_stop, abs(self.pos), True)

elif self.pos < 0:

self.intra_trade_high = bar.high_price

self.intra_trade_low = min(self.intra_trade_low, bar.low_price)

self.short_stop = self.intra_trade_low + self.atr_value1 * self.sl_multiplier

self.cover(self.short_stop, abs(self.pos), True)

self.put_event()

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass