阅读过知乎文章【Elite量化策略实验室】RUMI策略2之后, 打算在VeighNa社区开源版本上续写一个增加RAR(Regressed Annual Return), R_Cubed以及Robust_Shape指标的功能.

先附上详细运行过程文件ipynb, 位于github地址

接下来介绍一下各个指标的计算方法.

第一, RAR根据各个时间段的累计收益, 对时间长度做回归, 再转换成年化收益.

RAR回归方程示例

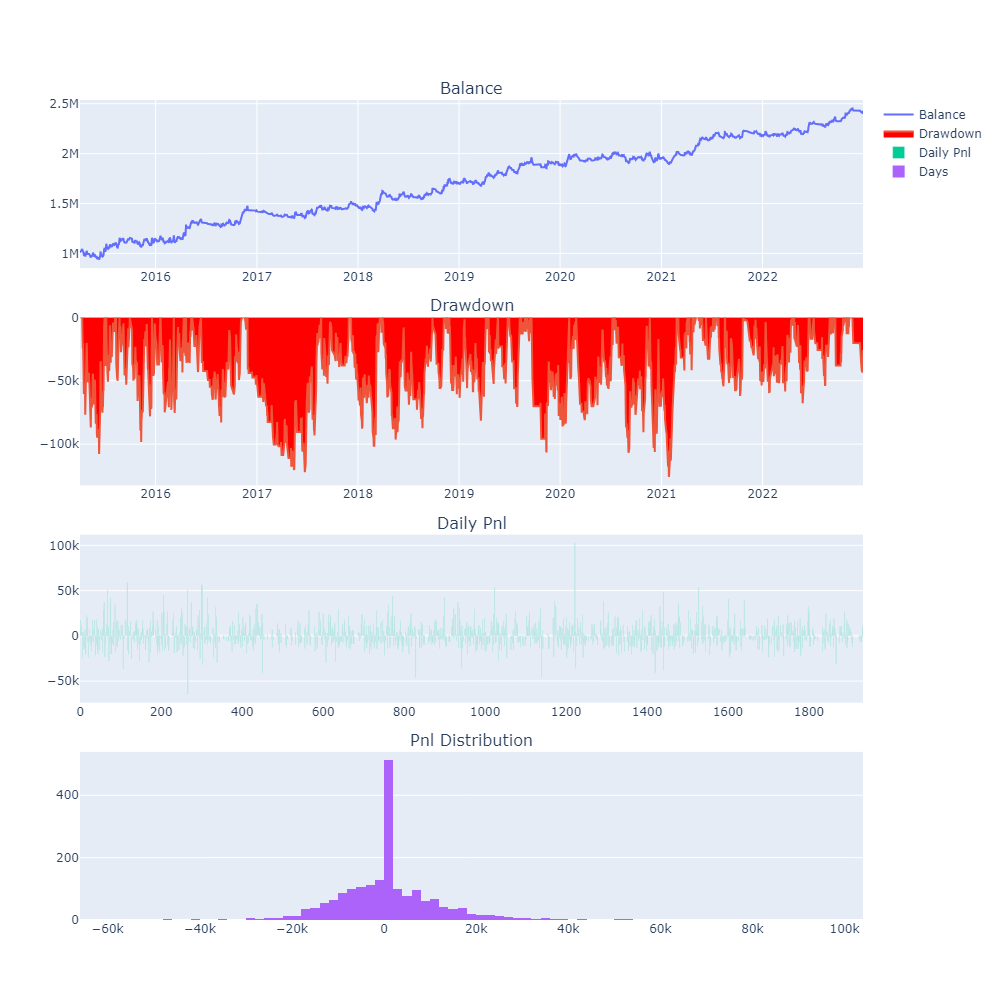

Backtesting for optimized Regressed Annual Return parameters, RAR参数优化之后的回测曲线

第二, R_Cubed根据书本<海龟交易法则>中描述, 以RAR为分子, 前五最大回撤平均值 * 对应回撤的平均天数为分母, 整体再乘上365天/年得到.

但是在计算的结果中发现, 原版公式最后优化得到的策略曲线并不优秀, 反复打印查看代码逻辑之后并没有发现错误点.(也可能是笔者能力有限, 欢迎大牛前来指正). 优化得到结果如下

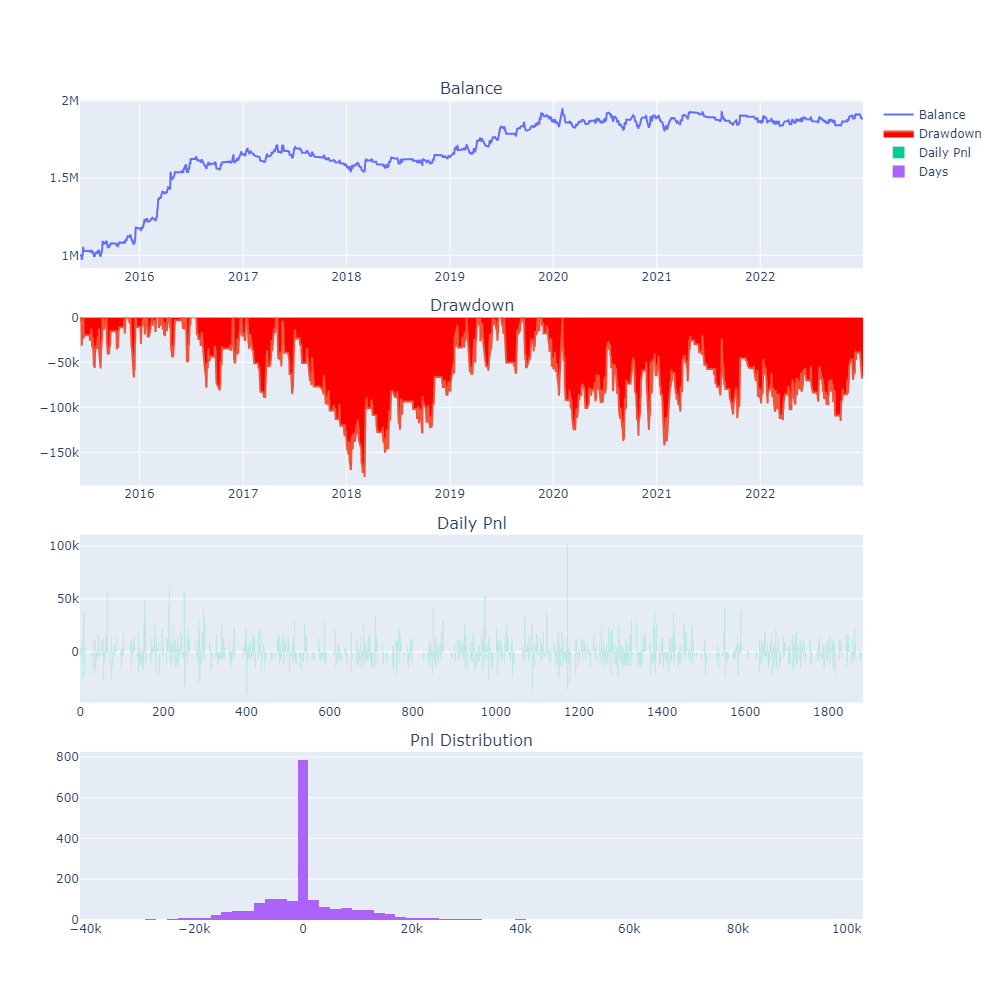

Backtesting for optimized original R-Cubed parameters, R-Cubed参数优化后的回测曲线

由于上述结果不佳, 对R_Cubed稍作修改, 仍以RAR为分子, 分母改成仅前五最大回撤的平均值. 修改后的R_Cubed比原版稍微正常一点.

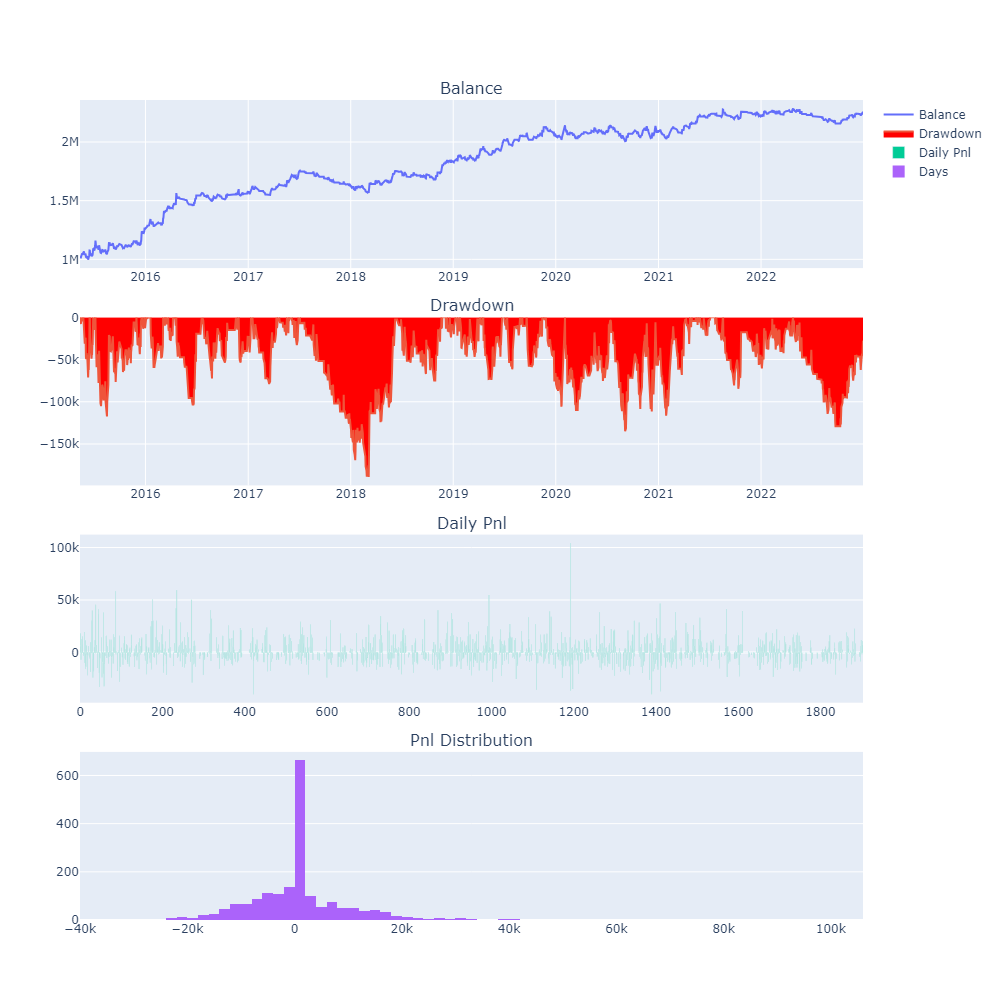

Backtesting for simplified R-Cubed parameters, 简化后的R-Cubed最优回测曲线

最后一个指标, Robust_Sharpe以RAR作为分子, 年化收益标准差为分母计算得到.

Backtesting for optimized Robust Sharpe parameters, Robust Sharpe参数优化后的回测曲线

完整的引擎代码如下

from pandas import DataFrame

from statsmodels.api import OLS

import statsmodels.api as sm

from pandas import Series

import numpy as np

from datetime import date, datetime, timedelta

from typing import List, Dict

from vnpy_ctastrategy.backtesting import (BacktestingEngine,

CtaTemplate,

Interval,

BacktestingMode,

OptimizationSetting,

check_optimization_setting,

run_bf_optimization,

run_ga_optimization,

get_target_value,

partial)

class BacktestingEngineNewStatistics(BacktestingEngine):

""""""

def __init__(self):

super().__init__()

self.ddpercent_only: bool = True # 用于控制计算R_cubed参数时, 是否考虑回撤周期长度的布尔开关.

def calculate_statistics(self, df: DataFrame = None, output=True) -> dict:

self.output("开始计算策略统计指标")

# Check DataFrame input exterior

if df is None:

df: DataFrame = self.daily_df

# Init all statistics default value

start_date: str = ""

end_date: str = ""

total_days: int = 0

profit_days: int = 0

loss_days: int = 0

end_balance: float = 0

max_drawdown: float = 0

max_ddpercent: float = 0

max_drawdown_duration: int = 0

total_net_pnl: float = 0

daily_net_pnl: float = 0

total_commission: float = 0

daily_commission: float = 0

total_slippage: float = 0

daily_slippage: float = 0

total_turnover: float = 0

daily_turnover: float = 0

total_trade_count: int = 0

daily_trade_count: int = 0

total_return: float = 0

annual_return: float = 0

daily_return: float = 0

return_std: float = 0

sharpe_ratio: float = 0

return_drawdown_ratio: float = 0

regressed_annual_return: float = 0

r_cubed: float = 0

robust_sharpe_ratio: float = 0

# Check if balance is always positive

positive_balance: bool = False

if df is not None:

# Calculate balance related time series data

df["balance"] = df["net_pnl"].cumsum() + self.capital

# When balance falls below 0, set daily return to 0

pre_balance: Series = df["balance"].shift(1)

pre_balance.iloc[0] = self.capital

x = df["balance"] / pre_balance

x[x <= 0] = np.nan

df["return"] = np.log(x).fillna(0)

df["highlevel"] = (

df["balance"].rolling(

min_periods=1, window=len(df), center=False).max()

)

df["drawdown"] = df["balance"] - df["highlevel"]

df["ddpercent"] = df["drawdown"] / df["highlevel"] * 100

# 添加部分 calculate regressed_annual_return

# df["cumreturn"] = (df["balance"] / self.capital - 1) * 100

df["cumreturn"] = df["return"].expanding(1).sum() * 100

# All balance value needs to be positive

positive_balance = (df["balance"] > 0).all()

if not positive_balance:

self.output("回测中出现爆仓(资金小于等于0),无法计算策略统计指标")

# Calculate statistics value

if positive_balance:

# Calculate statistics value

start_date = df.index[0]

end_date = df.index[-1]

total_days: int = len(df)

profit_days: int = len(df[df["net_pnl"] > 0])

loss_days: int = len(df[df["net_pnl"] < 0])

end_balance = df["balance"].iloc[-1]

max_drawdown = df["drawdown"].min()

max_ddpercent = df["ddpercent"].min()

max_drawdown_end = df["drawdown"].idxmin()

if isinstance(max_drawdown_end, date):

max_drawdown_start = df["balance"][:max_drawdown_end].idxmax()

max_drawdown_duration: int = (max_drawdown_end - max_drawdown_start).days

else:

max_drawdown_duration: int = 0

total_net_pnl: float = df["net_pnl"].sum()

daily_net_pnl: float = total_net_pnl / total_days

total_commission: float = df["commission"].sum()

daily_commission: float = total_commission / total_days

total_slippage: float = df["slippage"].sum()

daily_slippage: float = total_slippage / total_days

total_turnover: float = df["turnover"].sum()

daily_turnover: float = total_turnover / total_days

total_trade_count: int = df["trade_count"].sum()

daily_trade_count: int = total_trade_count / total_days

total_return: float = (end_balance / self.capital - 1) * 100

annual_return: float = total_return / total_days * self.annual_days

daily_return: float = df["return"].mean() * 100

return_std: float = df["return"].std() * 100

if return_std:

daily_risk_free: float = self.risk_free / np.sqrt(self.annual_days)

sharpe_ratio: float = (daily_return - daily_risk_free) / return_std * np.sqrt(self.annual_days)

else:

sharpe_ratio: float = 0

if max_ddpercent:

return_drawdown_ratio: float = -total_return / max_ddpercent

else:

return_drawdown_ratio = 0

# 计算regressed_annual_return

regressed_annual_return = calculate_regressed_annual_return(df, self.annual_days)

df.to_csv("df.csv")

# 计算各阶段回撤 calculate period dropdowns

dropdowns = find_periodic_dropdowns(df)

# 计算r-cubed指标

r_cubed = calculate_r_cubed(dropdowns, regressed_annual_return, self.ddpercent_only)

# 计算robust_sharpe_ratio

robust_sharpe_ratio = regressed_annual_return / (return_std * np.sqrt(self.annual_days))

# Output

if output:

self.output("-" * 30)

self.output(f"首个交易日:\t{start_date}")

self.output(f"最后交易日:\t{end_date}")

self.output(f"总交易日:\t{total_days}")

self.output(f"盈利交易日:\t{profit_days}")

self.output(f"亏损交易日:\t{loss_days}")

self.output(f"起始资金:\t{self.capital:,.2f}")

self.output(f"结束资金:\t{end_balance:,.2f}")

self.output(f"总收益率:\t{total_return:,.2f}%")

self.output(f"年化收益:\t{annual_return:,.2f}%")

self.output(f"最大回撤: \t{max_drawdown:,.2f}")

self.output(f"百分比最大回撤: {max_ddpercent:,.2f}%")

self.output(f"最长回撤天数: \t{max_drawdown_duration}")

self.output(f"总盈亏:\t{total_net_pnl:,.2f}")

self.output(f"总手续费:\t{total_commission:,.2f}")

self.output(f"总滑点:\t{total_slippage:,.2f}")

self.output(f"总成交金额:\t{total_turnover:,.2f}")

self.output(f"总成交笔数:\t{total_trade_count}")

self.output(f"日均盈亏:\t{daily_net_pnl:,.2f}")

self.output(f"日均手续费:\t{daily_commission:,.2f}")

self.output(f"日均滑点:\t{daily_slippage:,.2f}")

self.output(f"日均成交金额:\t{daily_turnover:,.2f}")

self.output(f"日均成交笔数:\t{daily_trade_count}")

self.output(f"日均收益率:\t{daily_return:,.2f}%")

self.output(f"收益标准差:\t{return_std:,.2f}%")

self.output(f"Sharpe Ratio:\t{sharpe_ratio:,.2f}")

self.output(f"收益回撤比:\t{return_drawdown_ratio:,.2f}")

self.output(f"Regressed Annual Return: \t {regressed_annual_return:,.4f}")

self.output(f"R-cubed Ratio: \t{r_cubed:,.4f}")

self.output(f"Robust Sharpe Ratio: \t{robust_sharpe_ratio:,.4f}")

statistics: dict = {

"start_date": start_date,

"end_date": end_date,

"total_days": total_days,

"profit_days": profit_days,

"loss_days": loss_days,

"capital": self.capital,

"end_balance": end_balance,

"max_drawdown": max_drawdown,

"max_ddpercent": max_ddpercent,

"max_drawdown_duration": max_drawdown_duration,

"total_net_pnl": total_net_pnl,

"daily_net_pnl": daily_net_pnl,

"total_commission": total_commission,

"daily_commission": daily_commission,

"total_slippage": total_slippage,

"daily_slippage": daily_slippage,

"total_turnover": total_turnover,

"daily_turnover": daily_turnover,

"total_trade_count": total_trade_count,

"daily_trade_count": daily_trade_count,

"total_return": total_return,

"annual_return": annual_return,

"daily_return": daily_return,

"return_std": return_std,

"sharpe_ratio": sharpe_ratio,

"return_drawdown_ratio": return_drawdown_ratio,

"regressed_annual_return": regressed_annual_return,

"r_cubed_ratio": r_cubed,

"robust_sharpe_ratio": robust_sharpe_ratio,

}

# Filter potential error infinite value

for key, value in statistics.items():

if value in (np.inf, -np.inf):

value = 0

statistics[key] = np.nan_to_num(value)

self.output("策略统计指标计算完成")

return statistics

def run_bf_optimization(

self,

optimization_setting: OptimizationSetting,

output: bool = True,

max_workers: int = None

) -> list:

""""""

if not check_optimization_setting(optimization_setting):

return

evaluate_func: callable = wrap_evaluate(self, optimization_setting.target_name)

results: list = run_bf_optimization(

evaluate_func,

optimization_setting,

get_target_value,

max_workers=max_workers,

output=self.output

)

if output:

for result in results:

msg: str = f"参数:{result[0]}, 目标:{result[1]}"

self.output(msg)

return results

run_optimization = run_bf_optimization

def run_ga_optimization(

self,

optimization_setting: OptimizationSetting,

output: bool = True,

max_workers: int = None

) -> list:

""""""

if not check_optimization_setting(optimization_setting):

return

evaluate_func: callable = wrap_evaluate(self, optimization_setting.target_name)

results: list = run_ga_optimization(

evaluate_func,

optimization_setting,

get_target_value,

max_workers=max_workers,

output=self.output

)

if output:

for result in results:

msg: str = f"参数:{result[0]}, 目标:{result[1]}"

self.output(msg)

return results

def calculate_regressed_annual_return(df: DataFrame, annual_days) -> float:

"""计算regressed_annual_return"""

X = np.linspace(1, len(df), len(df))

# 回归方程不需要添加常数项, 以y=ax为模型

Y1 = df["cumreturn"].values

model1 = OLS(Y1, X)

result1 = model1.fit()

# annualise fitted return

regressed_annual_return = result1.params[0] * annual_days

return regressed_annual_return

def calculate_r_cubed(dropdowns: List[Dict], regressed_annual_return: float, ddpercent_only: bool) -> float:

# 回测中有出现净值不断下跌的情况, 此时dropdowns会是个空值列表

if dropdowns:

dropdowns_sorted = sorted(dropdowns, key = lambda x:x["max_ddpercent"])

if len(dropdowns_sorted) > 4:

top_dropdowns_sorted = dropdowns_sorted[:5]

else:

top_dropdowns_sorted = dropdowns_sorted

top_max_dropdown_percents = [i["max_ddpercent"] for i in top_dropdowns_sorted]

top_max_dropdown_lengths = [i["max_ddpercent_length"] for i in top_dropdowns_sorted]

# 公式计算r-cubed

# 由于计算dropdown_length使用的是自然日, 则年化需要用365/年的常数.

average_top_dropdowns = abs(np.mean(top_max_dropdown_percents))

average_top_dropdowns_length = np.mean(top_max_dropdown_lengths)

if not ddpercent_only:

# 计算RAR/top平均回撤/top回撤时间*365天年化

r_cubed = regressed_annual_return * 365 / average_top_dropdowns / average_top_dropdowns_length

else:

# 只计算RAR/前N词平均回撤

r_cubed = regressed_annual_return / average_top_dropdowns

else:

r_cubed = 0.0

return r_cubed

def find_periodic_dropdowns(df: DataFrame) -> List[Dict[str, float]]:

dropdowns = []

current_dropdown = None

for index, row in df.iterrows():

ddpercent = row['ddpercent']

if not current_dropdown and ddpercent < 0:

# 新建一个 current_dropdown

current_dropdown = {

'start': index,

'max_ddpercent': ddpercent,

'end': index,

'max_ddpercent_length': 1

}

elif current_dropdown:

# 如果balance新高, 意味着本次回撤期结束.

if ddpercent == 0:

current_dropdown['end'] = index

dropdowns.append(current_dropdown)

current_dropdown = None

else:

current_dropdown['end'] = index

current_dropdown['max_ddpercent_length'] = (current_dropdown["end"] - current_dropdown["start"]).days

if ddpercent < current_dropdown['max_ddpercent']:

current_dropdown['max_ddpercent'] = ddpercent

return dropdowns

def new_evaluate(

target_name: str,

strategy_class: CtaTemplate,

vt_symbol: str,

interval: Interval,

start: datetime,

rate: float,

slippage: float,

size: float,

pricetick: float,

capital: int,

end: datetime,

mode: BacktestingMode,

ddpercent_only: bool,

setting: dict,

) -> tuple:

"""

Function for running in multiprocessing.pool

"""

engine: BacktestingEngineNewStatistics = BacktestingEngineNewStatistics()

engine.set_parameters(

vt_symbol=vt_symbol,

interval=interval,

start=start,

rate=rate,

slippage=slippage,

size=size,

pricetick=pricetick,

capital=capital,

end=end,

mode=mode

)

engine.ddpercent_only = ddpercent_only

engine.add_strategy(strategy_class, setting)

engine.load_data()

engine.run_backtesting()

engine.calculate_result()

statistics: dict = engine.calculate_statistics(output=False)

target_value: float = statistics[target_name]

return (str(setting), target_value, statistics)

def wrap_evaluate(engine: BacktestingEngine, target_name: str) -> callable:

"""

Wrap evaluate function with given setting from backtesting engine.

"""

func: callable = partial(

new_evaluate,

target_name,

engine.strategy_class,

engine.vt_symbol,

engine.interval,

engine.start,

engine.rate,

engine.slippage,

engine.size,

engine.pricetick,

engine.capital,

engine.end,

engine.mode,

engine.ddpercent_only

)

return func