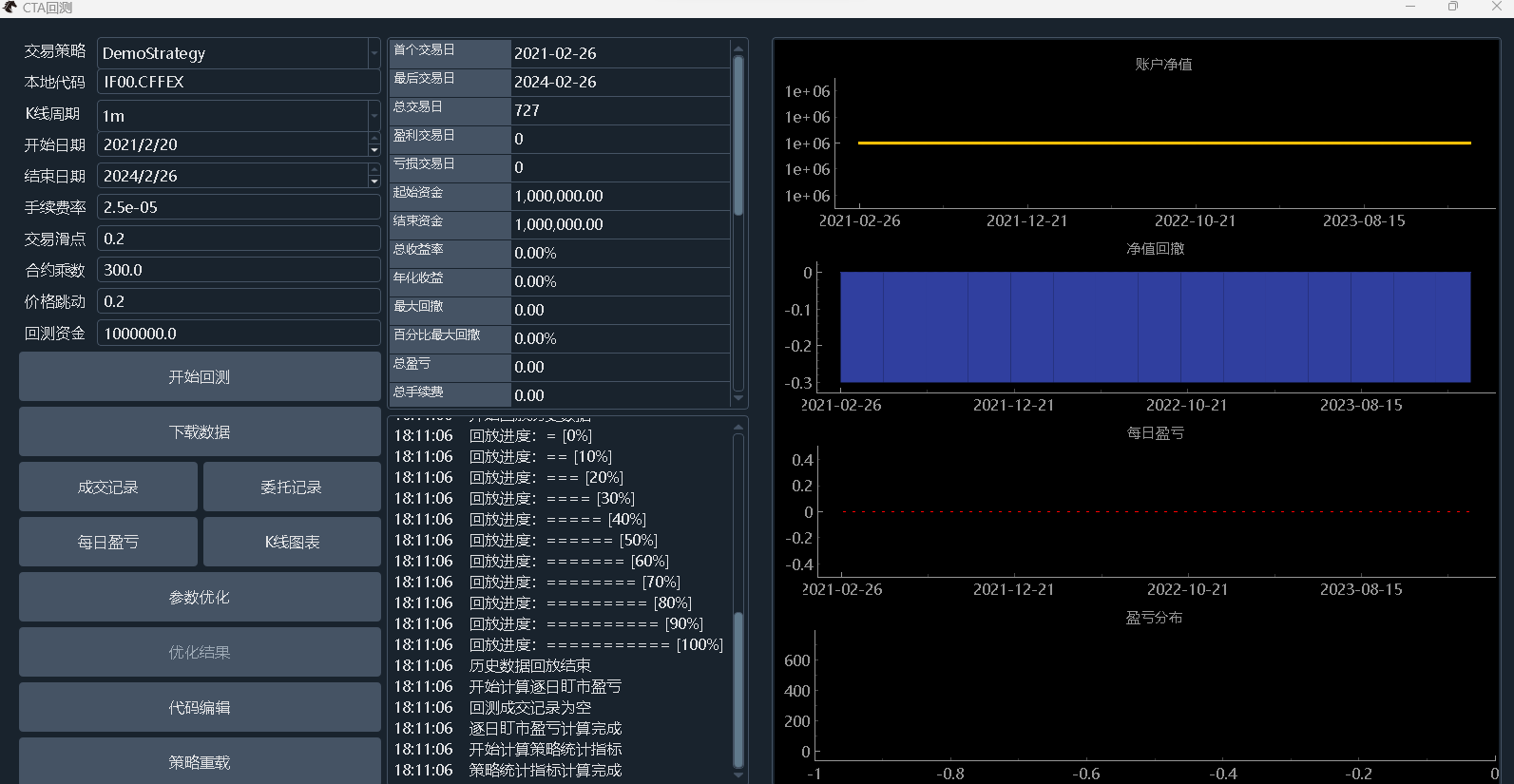

ui界面如图,成交记录为空,无委托发出(委托记录也是空的)

代码如下(和内置的双均线策略比对修改过,目前几乎是完全一样的):

from vnpy_ctastrategy import (

CtaTemplate,

StopOrder,

TickData,

BarData,

TradeData,

OrderData,

BarGenerator,

ArrayManager,

)

class DemoStrategy(CtaTemplate):

""""""

author: str = "abc"

#定义参数(parameter列表)

fast_window = 10

slow_window = 20

#定义变量(t时刻均线的数值和t-1时刻均线的数值,ma0是当前数值)

fast_ma0 = 0.0

fast_ma1 = 0.0

slow_ma0 = 0.0

slow_ma1 = 0.0

parameters: list = [

"fast_window",

"slow_window"

]

variables: list = [

"fast_ma0",

"fast_ma1",

"slow_ma0",

"slow_ma1"

]

def __init__(

self,

cta_engine,

strategy_name: str,

vt_symbol: str,

setting: dict,

) -> None:

super().__init__(cta_engine, strategy_name, vt_symbol, setting)

self.bg = BarGenerator(self, on_bar)

self.am = ArrayManager()

def on_init(self):

"""写策略日志,策略初始化"""

self.write_log("策略初始化")

"""加载均线"""

self.load_bar(10)

def on_start(self):

"""启动"""

self.write_log("策略启动")

self.put_event()

def on_stop(self):

"""停止"""

self.write_log("策略停止")

self.put_event()

def on_tick(self, tick:TickData):

self.bg.update_tick(tick)

"""双均线策略"""

def on_bar(self, bar:BarData):

"""k线更新"""

am = self.am

am.update_bar(bar)

if am.inited:

return

#计算技术指标

fast_ma = am.sma(self.fast_window, array = True)

self.fast_ma0 = fast_ma[-1]

self.fast_ma1 = fast_ma[-2]

slow_ma = am.sma(self.fast_window, array = True)

self.slow_ma0 = slow_ma[-1]

self.slow_ma1 = slow_ma[-2]

#判断均线交叉

cross_over = (self.fast_ma0 > self.slow_ma0 and

self.fast_ma1 < self.slow_ma1)

cross_below = (self.fast_ma0 < self.slow_ma0 and

self.fast_ma1 > self.slow_ma1)

#如果金叉,做多(空仓时,非空仓可不操作,有空单先平空单,price为挂单价格,5只是一个示例)

if cross_over:

price = bar.close_price + 5

if self.pos == 0:

self.buy(price, 1)

elif self.pos < 0:

self.cover(price, 1)

self.buy(price, 1)

#如果死叉,做空,仓位为零时做空,不为零时先平仓

elif cross_below:

price = bar.close_price - 5

if self.pos == 0:

self.short(price, 1)

elif self.pos > 0:

self.sell(price, 1)

self.short(price, 1)

#更新图形界面

self.put_event()

#实盘交易合成:任何国内交易所几乎只提供tick数据

def on_order(self, order: OrderData):

"""

Callback of new order data update.

"""

pass

def on_trade(self, trade: TradeData):

"""

Callback of new trade data update.

"""

self.put_event()

def on_stop_order(self, stop_order: StopOrder):

"""

Callback of stop order update.

"""

pass